Meanwhile, joint filers in the identical earnings bracket can obtain up to $360 when contributing at least $1,440. Of course, the smallest of Oregon companies are exempt from the CAT, apart from a $250 minimal payment, however most enterprise activity—and most employment—in Oregon comes from companies with nicely over $1 million in gross income. In all mixture price calculations that include the CAT in this publication, we are going to use the estimate of a 6.72 percent web revenue equivalent. Metro-area individuals and businesses face a dizzying array of taxes on income—nine in all, not counting a Clean Energy Surcharge described later. Whereas no class of revenue has all nine taxes imposed on it, each taxpayer faces several layers. Workers, business homeowners, and traders in Portland, Multnomah County, and the Metro area all experience these considerable burdens.

Oregon is one of a handful of states in the US that doesn’t have a basic sales tax or use tax. If you’re trying to plan ahead, the state offers a easy tax calculator to estimate your tax liability. This might help you understand what tax bracket you fall in and what to anticipate when submitting. Whether you’re a longtime resident or new to the Beaver State, getting acquainted with the fundamentals could make filing your taxes smoother. The CAT is imposed at a fee of zero.fifty seven p.c on gross income in excess of $1 million, with a subtraction for 35 percent of both labor costs or the price of goods bought, but not each.

Together, we can create a rustic with more financial justice, more racial justice, extra climate justice… and more tax justice. At VisaVerge, we perceive that the journey of immigration and travel is more than just a course of; it’s a deeply private expertise that shapes futures and fulfills goals. Our mission is to demystify the intricacies of immigration laws, visa procedures, and travel info, making them accessible and comprehensible for everybody.

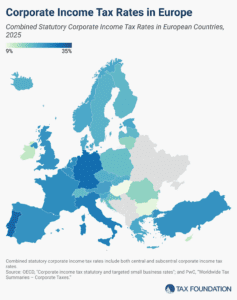

State Company Income Tax Rates And Brackets, 2025

At first look, zero.fifty seven p.c could not sound like much, but the truth that it’s on gross quite than net income, and that it pyramids, actually makes it an especially aggressive tax. This short publication explains the parts of Metro area taxes on earnings, demonstrates how they layer for various classes of income, and compares these combined rates on an apples-to-apples basis with the combined rates in different cities and states. Katelyn has more than 6 years of experience working in tax and finance. She believes information is the important thing to success and enjoys providing content material that educates and informs. TurboTax guides you step by step to ensure you claim every deduction and credit you qualify for.

This may influence which merchandise we evaluate and write about (and the place these products appear on the site), however it in no way impacts our recommendations or recommendation, which are grounded in 1000’s of hours of research. Our companions can’t pay us to guarantee favorable evaluations of their services or products. Whether you’re a full-year resident, part-year resident, or nonresident, TurboTax is right here to help. The following tax tables are supported by iCalculator™ US as a part of the suite of free tax tools available in the US Tax HUB we offer for Oregon. The standard deduction for a Head of Family Filer in Oregon for 2026 is $ four,560.00. California levies the best tax on gasoline at 70.9 cents per gallon (cpg), followed by Illinois at 66.four cpg and Washington at fifty nine.0 cpg.

And if you’ll like skilled tax help, merely connect with a TurboTax professional for personalized advice, or allow us to handle filing for you. We conduct rigorous analyses of tax and economic proposals and supply data-driven suggestions to shape equitable and sustainable tax systems. While Oregon doesn’t have a basic sales tax, it does tax the sale of alcohol. Oregon has a tax on wine at 67 cents per gallon and beer is taxed at just eight cents per gallon.

The EITC can have a big impact on a family’s annual finances, offering reduction and financial stability to tens of millions of People each year together with these in Oregon. The Earned Earnings Tax Credit (EITC) is a big tax credit score within the Usa, designed primarily to profit working individuals and families with low to reasonable revenue. As a refundable credit score, the EITC not only reduces the quantity of tax owed however can even lead to a refund if the credit exceeds the taxpayer’s total tax legal responsibility.

- Residents of Hawaii are burdened by taxes probably the most, whereas Alaska residents have the lowest tax burden, a brand new WalletHub examine found.

- Multnomah County’s business earnings tax is on net revenue of partnerships, S firms, and C companies, and is levied at a rate of two percent on net business revenue in the county.

- Prior yr returns can only be filed electronically by registered tax preparers for the 2 previous tax years.

Newest Data

A Number Of states try to hold things simple by making use of the same tax rate to most revenue. This means, for example, that a couple who made $500,000 shall be taxed at the same fee as a pair who made $75,000. And some states apply their tax rates to taxable earnings, whereas others use adjusted gross revenue. It is much like a federal earnings tax, however instead https://www.intuit-payroll.org/ funds state budgets quite than the federal authorities.

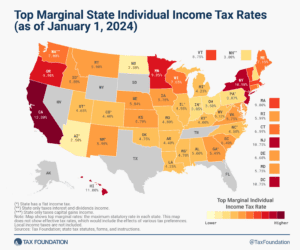

Private Income Tax

The four-bracket system and prime price of 9.9% stay in place, offering predictability for taxpayers. For immigrants and newcomers, it’s especially essential to grasp how Oregon’s tax system differs from other states or nations. For example, Oregon does not have a common sales tax, so income tax is the main state tax burden. This can have an effect on budgeting and monetary planning for new residents.

This makes the EITC a robust device for reducing poverty, incentivizing work, and offering financial help to those who need it most. The credit score amount varies based mostly on the taxpayer’s income, marital standing, and number of qualifying youngsters, with the intention of providing higher help to families with kids. The Earnings tax rates and private allowances in Oregon are updated annually with new tax tables printed for Resident and Non-resident taxpayers. The Tax tables under embrace the tax rates, thresholds and allowances included within the Oregon Tax Calculator 2026. We estimate the OBBBA will scale back federal taxes on common for particular person taxpayers in every state. Throughout all individual tax filers all through the US, the typical tax cut per taxpayer might be over $3,700 in 2026.